Balancing Current Bond Yields with Future Rate Changes

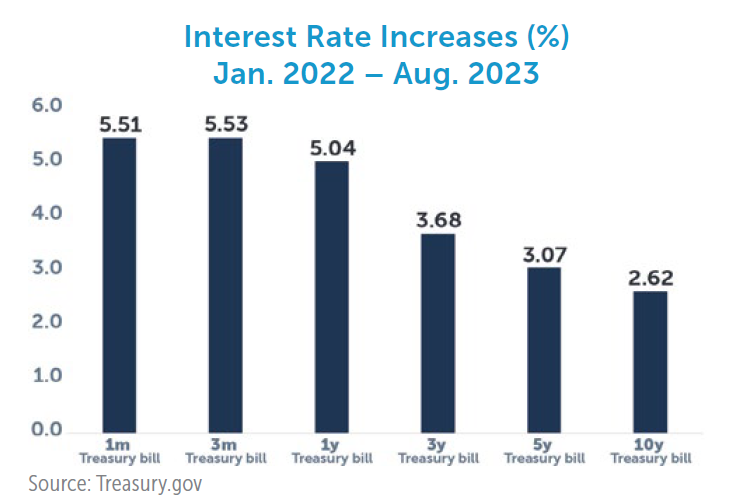

Following years of low returns, bonds are bouncing back. From 2022 to 2023, short-term Treasury bill rates have increased from near zero to over 5%. But when looking at the options in the fixed income market, investors are finding that the interest rates on bonds with more time to maturity haven’t increased as much as those with shorter maturities. That is leading to a question for some investors: Why not invest my entire fixed income allocation in the shortest maturity investments, where the rates are the highest?

This question is understandable. Given just how quickly interest rates have increased — and the consequently poor returns generated by fixed income in 2022 — some investors might expect that interest rates will simply continue to rise. Although we believe that keeping maturities on fixed income investments relatively short is typically the best approach, because it helps reduce a portfolio’s exposure to the risk of unexpected inflation, we do not believe that limiting a portfolio exclusively to the shortest maturities makes sense. There are three reasons for this perspective.

1. Interest rates are notoriously unpredictable.

There is no guarantee that short-term interest rates will stay at these levels over multiple years. Investing exclusively in the shortest-maturity fixed income investments exposes the investor to the risk that short-term interest rates fall more quickly than expected. This is commonly referred to as reinvestment risk, or the risk that rates will be lower than expected when you need to reinvest in the future. Said another way: Simply because you invest in the maturity with the highest interest rate today does not guarantee that this approach will generate the highest returns over a longer horizon. Short-term rates could fall enough that you would have been better off locking in a lower interest rate on an investment with a slightly longer maturity.

2. Not all interest rates move at the same time and by the exact same amounts.

The 2022–2023 period is a good example. By diversifying across multiple maturities, an investor can partially mitigate the risk of being overly exposed to movements in a single interest rate. Although not a perfect comparison, this is the same idea as not being overly exposed to the risk of a single stock.

3. The bigger risk is in the stock market.

For most portfolios, the greatest risk exposure comes from the stock market. This tends to be true because stock markets are significantly more volatile than fixed income markets. Investing only in fixed income with ultra-short terms amplifies this dynamic. Having some maturity risk in the portfolio can help better balance the overall portfolio.

The content of this article was provided by Buckingham Strategic Partners, not an employee of Kraft Asset Management.

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third-party data and may become outdated or otherwise superseded without notice. Third-party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this information. R-23-6178