Social Security and Medicare: How to Plan for Next Year

Each October, the Social Security Administration (SSA) announces how much, if any, benefit increase Social Security recipients will receive the following January, depending on the rate of inflation. As the 2024 increase is set to be less than that announced for 2023, retirees may be wondering what impact the Social Security adjustment will have on their Medicare costs next year. Here are some commonly asked questions about the changes coming, as well as tips to keep your Medicare costs lower, regardless of how much your Social Security benefits rise.

What is the COLA for 2024?

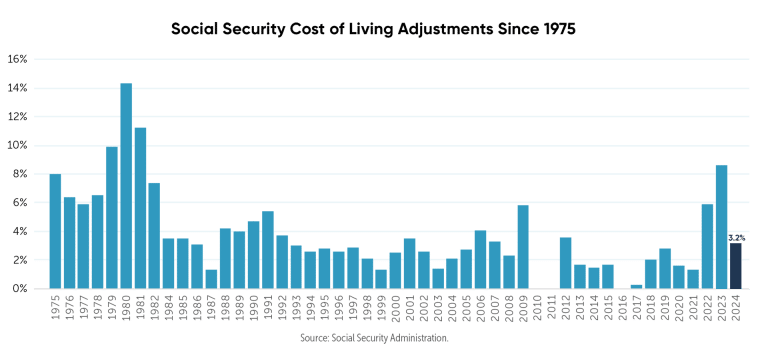

The cost-of-living adjustment (COLA) for 2024 is 3.2%, which the SSA estimates will raise the average monthly retirement benefit by about $59, to $1,906. Those currently receiving benefits should receive notification of their increase via their online Social Security account before the end of December and will receive the increased amount beginning in January. While this increase is considerably less than the 8.7% bump for 2023, which made plenty of headlines when announced last year, it is still higher than the 2.6% average over the past 20 years.

Will the COLA be enough to offset an increase in Medicare costs?

Medicare Part B and Part D are the coverage options most susceptible to annual changes in costs. Medicare Part B covers medical services like doctors’ visits and outpatient care while Part D covers your prescription drugs. It’s generally best to have Part D coverage as well, especially as you age and may require specific medications.

The SSA typically deducts Medicare Part B premiums from Social Security benefits, so as many recipients know, the financial impact from an increase in Social Security benefits may be muted. While there have been years in which Part B premiums remained unchanged from year to year, in 2023, the standard premiums decreased for the first time in over a decade, which allowed recipients to benefit more from the 8.7% COLA. This year, the Centers for Medicare & Medicaid Services (CMS) announced 2024 Part B premiums earlier than anticipated. The standard premium will increase next year by $9.80 to $174.70. This is lower than some feared and means Social Security recipients whose Part B premiums are deducted from their monthly benefits can still expect some increase in income next year given the recently announced COLA.

How else might my Social Security benefits affect Medicare costs?

It’s important to consider that an increase in Social Security payments could actually raise your Medicare costs if it pushes you into a higher income threshold. That’s because your income can affect your Medicare premiums for Part B and Part D coverage. People with high incomes (over $97,000 for a single individual and over $194,000 for a married couple in 2023) pay higher premiums for Part B and Part D.

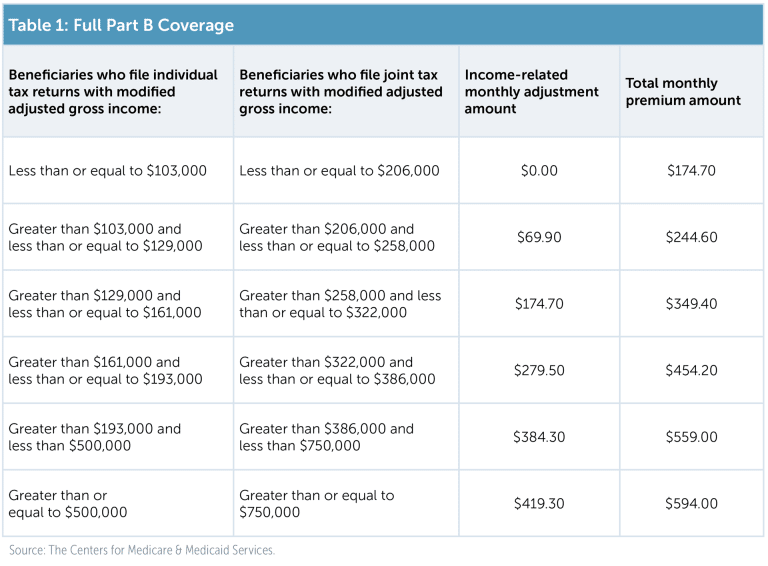

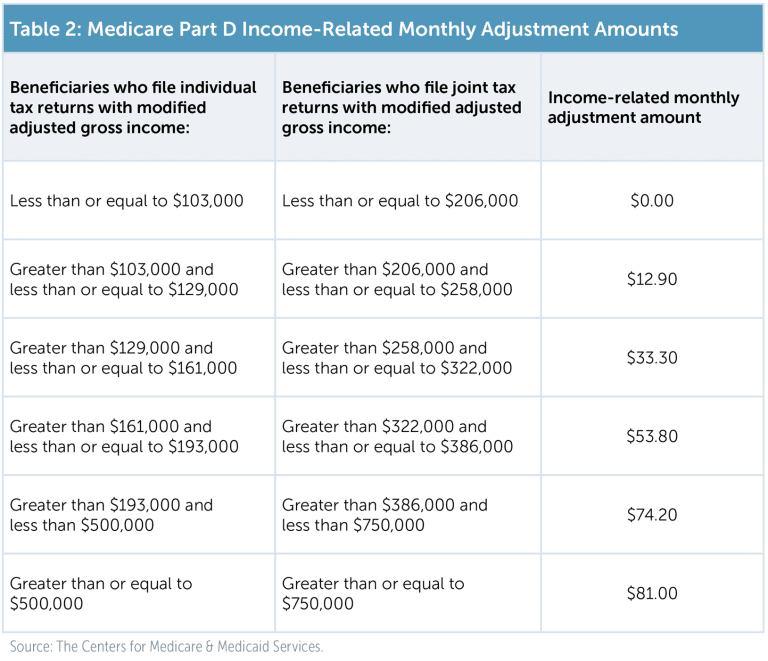

If you earn over the income thresholds, which are announced annually, you’ll pay an income-related monthly adjusted amount (IRMAA) – a surcharge added to the Part B and Part D premiums. If your income is slightly below the tier, the increase you receive in Social Security income may push you over that threshold, causing you to pay a higher amount for both Part B and Part D benefits. Based on the recently announced changes for 2024, the tables below indicate how your income level can affect your Medicare Part B and D premiums.

Medicare premiums are based on a two-year lookback framework, meaning Social Security reviews your tax return from two years prior. Therefore, for 2024 rates, Social Security will use your 2022 federal tax return to determine which of the tiers you fall under.

Medicare Part B income-related monthly adjustment amounts for 2024:

Medicare Part D income-related monthly adjustment amounts for 2024:

Strategies to keep Medicare costs under control

To prevent your Medicare premiums from rising based on a change in income, it’s best to consult a team of financial professionals who can help apply tax strategies that include being mindful of IRMAA. We also recommend reviewing your Part D plan annually to ensure it meets your specific needs. Even if your medications stay the same, individual plans may adjust their prescription costs, preferred pharmacies or the drugs they cover, so it can be helpful to review this with your financial advisor each year.

Legislative changes stemming from the Inflation Reduction Act of 2022 should also help reduce health care costs for Medicare recipients. One particularly impactful change that should help Medicare Part D recipients save money is the elimination of the donut hole, a coverage gap in which individuals are not covered for their prescription costs and must pay out of pocket. This change will cap overall Medicare Part D costs at $2,000 annually per individual starting in 2025.

Another change to Medicare Part D plans that went into effect in 2023 relates to insulin-related costs. For those on Medicare, the cost is now limited to a maximum copay of $35 per month. This should provide savings for insulin-dependent diabetics who have grappled with the rising costs of this medication over the last decade or two.

Your financial advisor can help

Historically, Medicare premiums have risen faster than Social Security COLAs. However, when factoring in the upcoming legislative changes to Medicare benefits, as well as incorporating health care planning with your financial advisor, there are plenty of strategies to reduce your Medicare costs that can lead to significant savings over the long term.

The above considerations are just a handful of ways a financial advisor can help review your Social Security benefits and suggest strategies to lower Medicare costs. Please reach out to your advisor to discuss the best options for your situation. If you are not presently working with one, we would love to help you.

This article originally appeared October 23rd on BuckinghamStrategicPartners.com

For informational and educational purposes only and should not be construed as specific investment, accounting, legal, or tax advice. Certain information is based on third party data information and may become outdated or otherwise superseded without notice. Individuals should speak with a qualified financial professional based on their circumstances. Third party information is deemed to be reliable, but its accuracy and completeness cannot be guaranteed. Neither the Securities and Exchange Commission (SEC) nor any other federal or state agency have approved, determined the accuracy, or confirmed the adequacy of this information. R-23-6359