Wealth and Investment Management

Investment Management

Having a well-defined investment strategy is important now and into the future. It serves as a road map to temper decisions that might otherwise be based on intuition or emotion. Investment planning includes establishing your goals, developing defined strategies to achieve those goals, implementing these strategies and monitoring your progress in attaining those goals.

Set Goals

The goal setting process begins with an initial meeting during which we will gather financial and non-financial data. The first step in developing an investment strategy is to understand your unique goals and objectives. We help you balance and identify changing needs within your career and creative aspirations, charitable goals, family sharing time, and social and leisure activities.

Develop Strategy

After thorough analysis and planning, we will help you develop a long-range investment strategy designed to achieve your goals and objectives. The output of the goal-setting and planning process will be a written investment plan. This document will formalize — in writing — your financial and non-financial goals, investment time horizon and tolerance for risk.

Re-Balance

Re-balancing is the process of restoring a portfolio to its original asset allocations and risk profile. It is an ongoing process because each asset class within the portfolio is likely to shrink or grow by a different percentage over time — altering the risk (and expected return) — of the portfolio. Re-balancing in good times, when markets are rising, enables you to develop the skills and the discipline to also do it in tough times.

Follow up

Your relationship with us is an ongoing process that continuously monitors your progress toward achieving your stated goals and objectives. You will be encouraged to meet with us on a regular basis to review your investment strategy plan and investment performance. As your life and circumstances change, it is essential that we continually review where you are financially and what new steps need to be taken.

Comprehensive Financial Planning

We take a holistic, all-encompassing approach to wealth management, and managing investments represents only part of the picture. With wide-ranging experience and expertise in a variety of other financial areas, we are able to serve as the “quarterback” of our clients’ broader financial teams.

We work intimately with our clients to uncover their most important values, goals and relationships and work with their attorneys and CPAs to address all parts of their financial life. This deep knowledge forms the foundation for each client’s comprehensive, individualized plan.

Estate Planning

Estate planning is the process of developing a strategy to facilitate the transfer of your personal assets to your beneficiaries. At Kraft Asset Management, LLC we understand the importance of properly structuring and regularly reviewing your estate plan to ensure that it is addressing your family’s needs. While we are not attorneys and do not prepare any legal documents, we do work closely with our clients and their attorneys and CPAs in developing a prudent estate plan.

Risk Management

Risk management and asset protection strategies are designed to insulate your family, your assets and your income from potential loss. It’s a structured approach to managing uncertainties that could affect your financial well being. Using a consultative approach, we can assist you in assessing the risks and developing strategies to manage them through our strategic alliances.

Retirement Planning

When considering retirement, you must ask yourself some important questions: What did I not have time for when I was working? What activities do I enjoy participating in the most? Retirement planning encompasses analyzing current retirement assets, estimating anticipated contributions and earnings, and projecting future anticipated living needs. Planning for inflation and incorporating a probability analysis are key components in developing a prudent retirement plan. Our goal is to help you develop a long-range retirement plan that will allow you to obtain financial independence and maintain your standard of living.

Cash Flow Management

Meeting your cash flow needs from your portfolio is important. When we construct your portfolio, we take into account any known or anticipated cash flow needs you have from your portfolio. We structure your portfolio by focusing on tax consequences, selecting the appropriate financial instruments and minimizing trading costs to accommodate your cash needs.

Income Tax Planning

Income tax planning is an integral part of an investment strategy. Income tax planning allows you to maximize your legitimate deductions and reduce or eliminate federal, state and local taxes. We can assist you in structuring an investment strategy that reduces the impact of taxes on your return.

Insurance Planning

Through Kraft Financial Services, LLC, we help our clients manage risk and achieve financial security through life insurance. We work with only financially sound insurance companies and our recommendations are independent of any particular insurance company product.

Education Planning

Planning for college can be an exciting time, but it also can be expensive. There are credits, deductions and other tax-savings opportunities that you should be taking advantage of, like 529 plans. We can educate you on the options and develop a plan that works for your family.

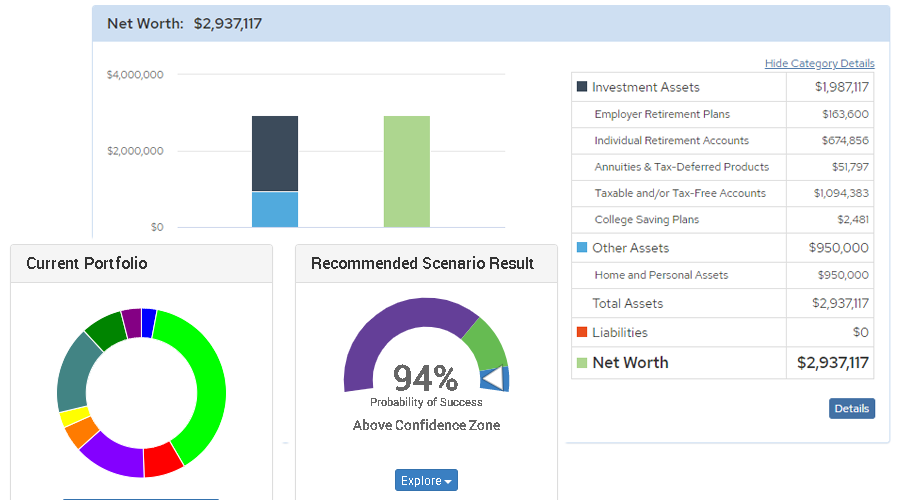

User-Friendly Financial Dashboards

Kraft Asset Management's investment advisors utilize MoneyGuideElite® financial planning software to provide customized, goal-oriented plans for each unique client. Below is a sample client dashboard.

Sample dashboard is for illustrative purposes only.