Next Generation Financial Planning

now a subscription service

It's never too early to start on the path to financial success. Establishing a clear vision of your personal, family and professional priorities and goals is the first step. Developing a financial plan is an important vehicle to help you establish your goals, develop defined strategies to achieve those goals, implement these strategies and monitor your progress in attaining those goals.

Next Generation Financial Planning

Next Generation Financial Planning is a subscription service designed to help younger investors get started by developing a customized financial plan. With wide-ranging experience and expertise in a variety of financial areas, we are able to serve as the “quarterback” of our clients’ broader financial teams.

We work intimately with our clients to uncover their most important values, goals and relationships and work with their attorneys and CPAs to address all parts of their financial life. Young investors often need help with creating a budget, paying off credit cards and student loans, creating an emergency fund, and saving for college, as well as advice on risk management, retirement plans, social security, wills, POAs, living wills and trusts. Learn more about our financial planning services.

The subscription-service format allows young clients to ease into financial planning and investing with experienced financial advisors to guide them along the way.

Let us help you develop the plan and the discipline to invest wisely and consistently so you can start to build wealth for the future — while still enjoying life along the way.

Next Generation Financial Planning Subscription Benefits

As a Kraft Asset Management Next Generation Financial Planning subscriber, you will have access to the following:

Industry Veterans

Our professionals are industry veterans in the fields of financial planning and wealth management, including Certified Public Accountants, Personal Financial Specialists, CERTIFIED FINANCIAL PLANNER™ Professionals*, and those with FINRA Series 7 & 65 Licenses and Life Insurance Licenses.

More Than Just Investment Platforms

We offer more than just investment platforms. We will develop a financial plan designed specifically for you and your family and help you implement, monitor and adapt it as you experience changes in your personal life and career.

MoneyGuideElite®

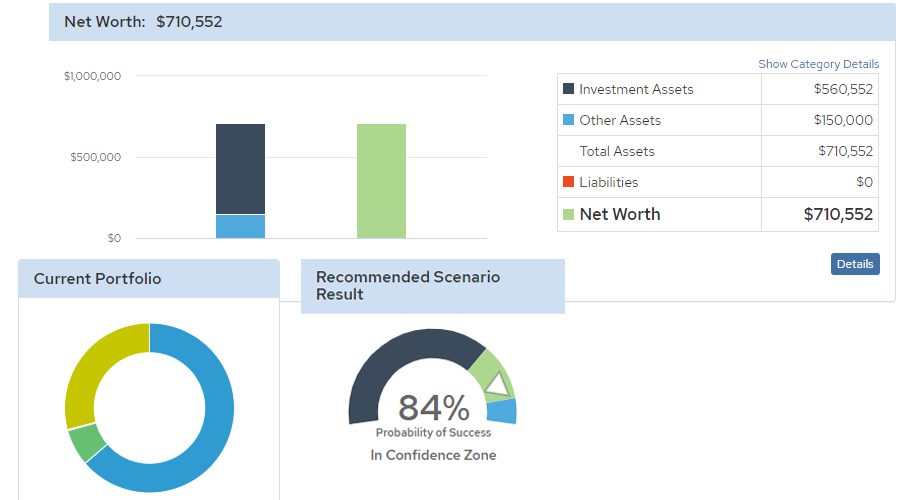

MoneyGuideElite®, a robust financial planning software that allows us to consolidate all of your financial information (i.e. bank accounts, investment accounts, 401(k)s) into one user-friendly, web-based dashboard and smart phone app. See a sample dashboard below.

Tax & Accounting Professionals

Through our affiliation with KraftCPAs PLLC**, one of Nashville's largest certified public accounting firms, you'll have access to top notch tax, accounting and financial professionals (if needed).

* Certified Financial Planner Board of Standards Inc. owns the certification marks CFP®, CERTIFIED FINANCIAL PLANNER™ and CFP® in the U.S., which it awards to individuals who successfully complete CFP Board’s initial and ongoing certification requirements. **Tax, accounting and other financial services provide by KraftCPAs PLLC are available for an additional fee.

Next Generation Financial Planning Subscription Parameters and Components

Kraft Asset Management's Next Generation Financial Planning subscription service is designed for investors with:

- a minimum investment amount of $100,000 and maximum amount of $500,000

- minimum annual additions of $12,000

- a minimum net worth of $350,000

To get you started with the Next Generation Financial Planning subscription service, we will do the following:

Onboarding

We will set-up an onboarding video conference to explain the components of the subscription service, understand your current financial situation, uncover your values and goals, and collect data to develop a plan.

MoneyGuideElite®

We will establish an account for you on MoneyGuideElite®, the financial planning software we use to provide customized, goal-oriented plans for clients.

Financial Plan

We will take the information gathered in the onboarding interview along with your financial data to develop a customized financial plan covering all the areas listed above.

Plan Review

We will set-up an in-person meeting to discuss your financial plan, establish connections with estate attorneys, CPAs, and insurance agents (if needed), and explain your dashboards & reports in MoneyGuideElite®.

Follow-Up

One of our most important responsibilities is to help you implement and monitor your financial plan. Your plan is not a static document and should be updated as you go through personal and career changes. After the initial financial plan is created and approved, you will receive three "check-in" video conferences (at your discretion) and three "quick question" calls per year. You will also receive one annual, in-person plan "check-up" meeting.

User-Friendly Financial Dashboards

Kraft Asset Management's advisors utilize MoneyGuideElite® financial planning software to provide customized, goal-oriented plans for each unique client. Below is a sample for an individual/family client.

Sample dashboard is for illustrative purposes only.