Third quarter 2021 market perspective

Our evidence-based investing portfolios are strategically invested with a focus on long-term performance objectives. Portfolio allocations and investments are not adjusted in response to market news or economic events; however, we evaluate and report on market and economic conditions to provide our investors with perspective and to put portfolio performance in proper context.

During the third quarter, global stock markets retracted slightly, reversing the trend from the previous quarter. Politics and global affairs were front and center in September as the uncertain future of Chinese real estate group Evergrande sparked concern among investors internationally, and the continued debate in Congress over raising the U.S. federal debt ceiling caused apprehension in markets at home and abroad. As was the case during the previous quarter, investors continued to eye potential action by the Federal Reserve as markets continued to price in elevated inflation expectations. These events and other factors were able to stall overall stock market growth for the quarter.

For the quarter, U.S. stocks (as measured by the Russell 3000 Index) lost 0.1%, and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S.) lost 0.7%. Emerging market stocks (as measured by the MSCI Emerging Markets Index) lost 7.4%.

The U.S. Dollar Index, a measure of the value of the United States dollar relative to a basket of foreign currencies, increased during the quarter—the U.S. dollar increased by 4.8% compared to foreign currencies. Over the past 12 months, the U.S. dollar increased by 0.4%. The increase in the dollar is a headwind to non-U.S. investments held by U.S. investors for the last 12 months.

U.S. interest rates remained unchanged during the quarter as the Fed continues to maintain a target range of 0.0% to 0.25% for the Fed Funds rate.

U.S. Economic Review

Continuing the trend of economic expansion from the previous quarter, the final reading for second quarter 2021 GDP showed an annualized increase in economic growth of 6.7%. The unemployment rate finished the quarter at 4.8%, which is the first time unemployment has been under 5% since the pandemic began. Domestic inflation showed a reading of 3.6% in August 2021 as the Fed’s preferred gauge of overall inflation, the core Personal Consumption Expenditures (PCE) index, remained above the Fed’s long-term target average of 2.0%.

Financial Markets Review

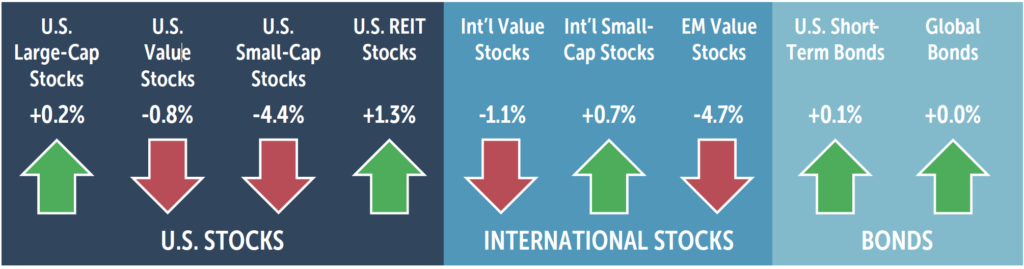

Domestically, large-cap stocks and REIT stocks posted positive performance for the quarter while only small-cap stocks were positive internationally. Value stocks receded globally. International stock returns were also impacted during the quarter by the strengthening U.S. dollar. During the quarter, U.S REITs were the best performing and emerging market value stocks were the worst performing. U.S. and global bonds were each up slightly during the quarter.

Source: Morningstar Direct July 2021. Market segment (Index representation) as follows: U.S. Large-Cap Stocks (Russell 1000 Index), U.S. Value Stocks (Russell 1000 Value Index), U.S. Small-Cap Stocks (Russell 2000 Index), U.S. REIT Stocks (Dow Jones U.S. Select REIT Index), International Value Stocks (MSCI World Ex USA Value Index (net div.)), International Small-Cap Stocks (MSCI World Ex USA Small Index (net div.)), Emerging Markets Value Stocks (MSCI Emerging Markets Value Index (net div.)), U.S. Short-Term Bonds (ICE BofA 1-3Y US Corp&Govt TR), Global Bonds (FTSE WGBI 1-5 Yr Hdg USD).

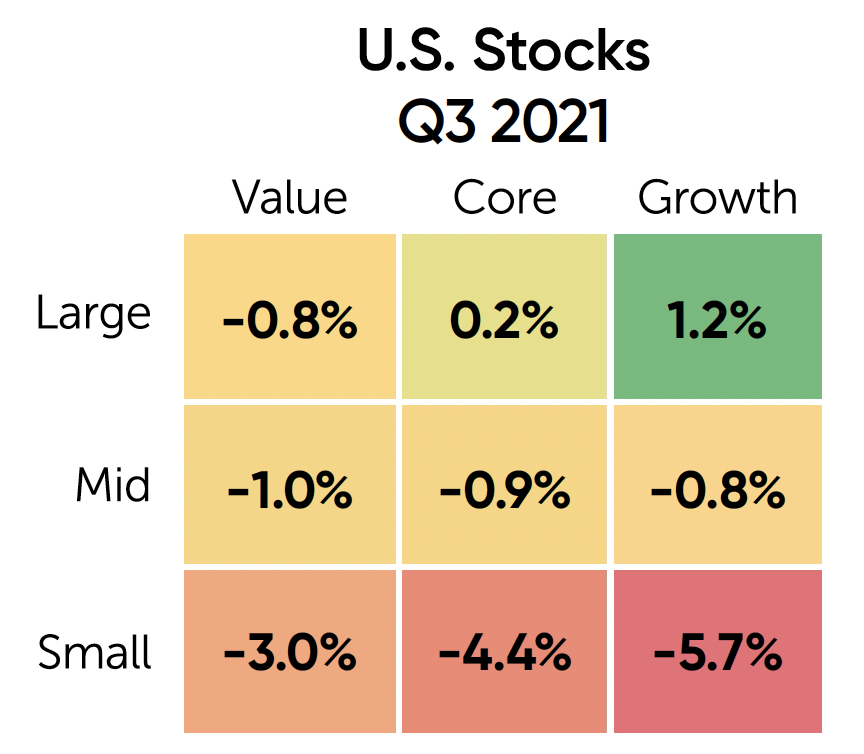

In the U.S., large-cap stocks outperformed smallcap stocks in all style categories. Growth stocks outperformed value stocks in all size categories except small-cap stocks. Among the nine style boxes, large-cap growth stocks performed the best and small-cap growth stocks experienced the largest decline during the quarter.

Source: Morningstar Direct October 2021. U.S. markets represented by respective Russell indexes for each category (Large: Russell 1000, Value, and Growth, Mid: Russell Mid Cap, Value, and Growth, Small: Russell 2000, Value, and Growth).

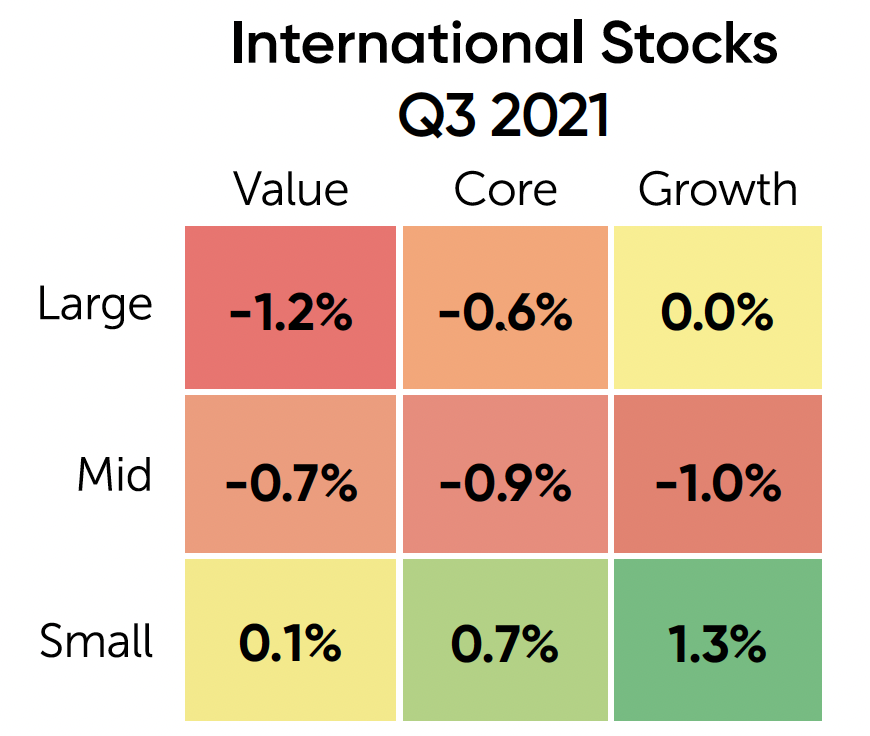

In developed international markets, small-cap stocks outperformed large-cap stocks in all style categories for the quarter. Growth stocks outperformed value stocks in all size categories with the exception of mid-cap stocks. Among the nine style boxes, international small-cap growth stocks performed the best and international large-cap value stocks experienced the largest decline during the quarter.

Source: Morningstar Direct October 2021. International markets represented by respective MSCI World EX USA index series (Large: MSCI World EX USA Large, Value, and Growth, Mid: MSCI World Ex USA Mid, Value, and Growth, Small: MSCI World Ex USA Small, Value, and Growth).

A diversified index mix of 60% stocks and 40% bonds would have lost 0.5% during the third quarter.

Let us help you sort through the clutter and weather the market’s uncertainties. Please call us if you have questions or concerns.

60/40 Index Mix: 30% U.S. Large Cap (S&P 500 Index), 6% U.S. Small Value (Russell 2000 Value Index), 12% International Large Cap (MSCI World ex USA Index net div.), 6% International Small Value (MSCI World ex USA Small Value Index net div.), 6% Emerging Markets Total Stock Market (MSCI EM IMI net div.), 20% Global Short Bonds (FTSE WGBI 1-5yr Hdg USD Index), 20% U.S. Intermediate Government Bonds (BBgBarc US Govt Interm TR index).

Indexes are unmanaged baskets of securities that are not available for direct investment by investors. Index performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Foreign securities involve additional risks, including foreign currency changes, political risks, foreign taxes, and different methods of accounting and financial reporting. Emerging markets involve additional risks, including, but not limited to, currency fluctuation, political instability, foreign taxes, and different methods of accounting and financial reporting. All investments involve risk, including the loss of principal, and cannot be guaranteed against loss by a bank, custodian, or any other financial institution.

© Buckingham Strategic Partners 2021. All Rights Reserved. IRN-21-2792