Focus on long-term performance objectives

Market Commentary: Q1 2020 in Perspective

Buckingham’s evidence-based investing portfolios are strategically invested with a focus on long-term performance objectives. Portfolio allocations and investments are not adjusted in response to market news or economic events; however, we evaluate and report on market and economic conditions to provide our investors with perspective and to put portfolio performance in proper context.

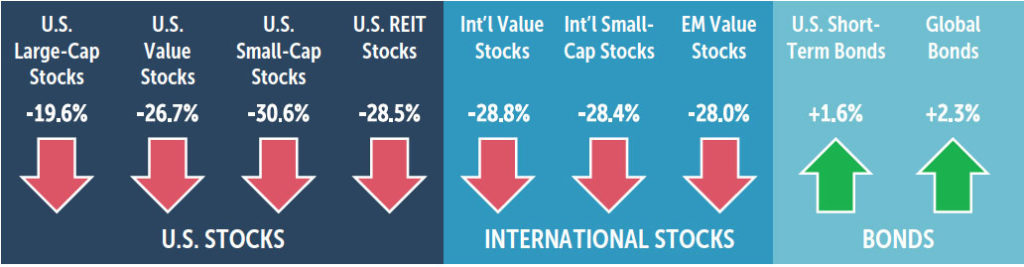

Global stock markets declined to start the year and effectively erased investor gains from 2019. Both domestic and international fixed income served as a ballast to investor portfolios during the quarter. Falling oil prices, heightened market volatility, and the global spread of the COVID-19 virus all provided large hurdles to market growth.

For the quarter, U.S. stocks (as measured by the S&P 500 Index) lost 19.6%, and non-U.S. developed market stocks (as measured by the MSCI World Ex U.S. Index) lost 23.3%. Emerging market stocks (as measured by the MSCI Emerging Markets Index) lost 23.6%.

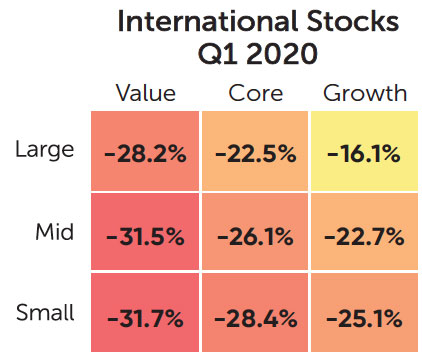

The U.S. Dollar Index, a measure of the value of the U.S. dollar relative to a basket of foreign currencies, rose in the first quarter—the U.S. dollar increased by 2.8% compared to foreign currencies. Over the past 12 months, the U.S. dollar has appreciated by 1.8%. The increase in the dollar is a headwind to non-U.S. investments held by U.S. investors.

U.S. interest rates fell during the quarter as the Federal Reserve implemented a 1.50% rate reduction to the federal funds rate. The Fed now targets a range of 0.0% to 0.25% for the federal funds rate. Because changes in interest rates and bond prices are inversely related, the decline in interest rates helped increase the quarterly return for many bond asset classes.

U.S. Economic Review

Positive economic growth in the U.S. continued in the fourth quarter of 2019. The final reading for fourth quarter 2019 GDP showed an increase in economic growth of 2.1%. Despite the economic progress of the past 10 years, a slowdown in economic activity due to COVID-19 has started to show in more recent economic data points. The unemployment rate climbed from 50-year lows to 4.4% in March 2020. Domestic inflation remains tame, as the Fed’s preferred gauge of overall inflation, the core Personal Consumption Expenditures (PCE) index, stayed below the central bank’s 2.0% target with a reading of 1.8% in February 2020.

Sources: Bureau of Economic Analysis, Bureau of Labor Statistics, U.S. Department of the Treasury, Morningstar Direct 2020.

Financial Markets Review

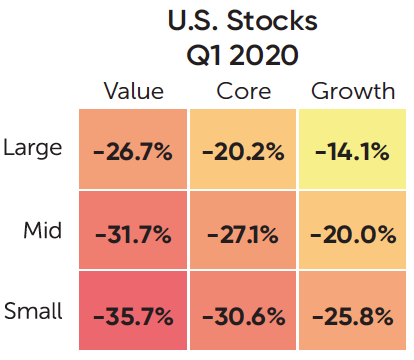

Both domestic and international stocks across all size and style categories, as well as U.S. real estate investment trust (REIT) securities, declined during the quarter. Non-U.S. stock returns were also impacted by the strengthening U.S. dollar. During the quarter, U.S. large-cap stocks were the best performing asset class while U.S. small-cap stocks were the worst performing. U.S. and global bonds continued performance from the previous quarter by posting positive results.

In the U.S., small-cap stocks underperformed large-cap stocks in all style categories. Value stocks underperformed growth stocks in all style categories. Among the nine style boxes, large-cap growth stocks performed the best and small-cap value stocks experienced the largest loss during the quarter.

In developed international markets, all nine style boxes were negative for the quarter. International large-cap growth stocks were the highest performer. Similar to the U.S., small-cap stocks underperformed large-cap stocks across all styles.

A diversified index mix of 65% stocks and 35% bonds would have lost 16.5% during the first quarter.

65/35 Index Mix: 2% Cash (BofA ML 3M US Treasury Note TR), 16% ST U.S. Fixed Income (BofA ML Corp&Govt 1-3 Yr TR), 17% Global Bonds (FTSE WGBI 1-5 Yr Hdg USD), 15% U.S. Large (S&P 500 Index), 12% U.S. Value (Russell 1000 Value Index), 8% U.S. Small (Russell 2000 Index), 4% U.S. REITs (Dow Jones U.S. Select REIT Index), 14% Intl Large Value (MSCI World Ex USA Value Index (net div.)), 7% Intl Small (MSCI World Ex USA Small Index (net div.)), 5% Emerging Markets Value (MSCI Emerging Markets Value Index (net div.)).Indexes are unmanaged baskets of securities that are not available for direct investment by investors. Index performance does not reflect the expenses associated with the management of an actual portfolio. Past performance is not a guarantee of future results. Foreign securities involve additional risks, including foreign currency changes, political risks, foreign taxes, and different methods of accounting and financial reporting. Emerging markets involve additional risks, including, but not limited to, currency fluctuation, political instability, foreign taxes, and different methods of accounting and financial reporting. All investments involve risk, including the loss of principal, and cannot be guaranteed against loss by a bank, custodian, or any other financial institution. ©Buckingham Strategic Partners 2020. All Rights Reserved.