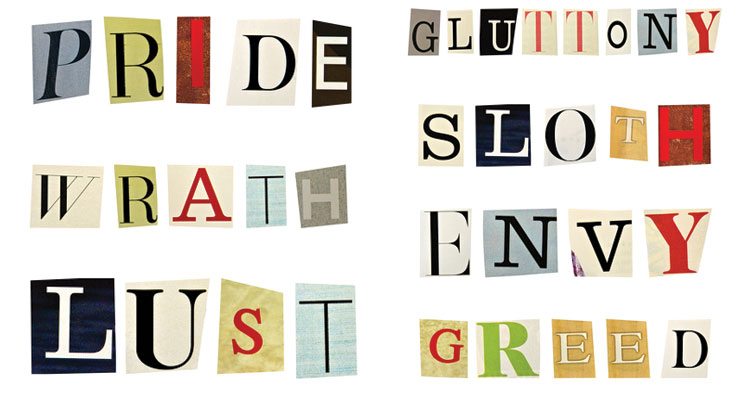

Avoid the seven deadly sins of investing

By Stephen High

Investment mistakes happen. When they do, money is lost and confidence is diminished. Learning to recognize common investing mistakes can help you avoid these undesirable consequences.

There are a number of errors people make when it comes to investing. We will review the “seven deadly sins” and offer solutions to help you steer clear of temptation.

1 Pride: being overconfident

Investors’ opinions of their investment skills are often too high. Being overconfident can be costly. The odds are against you, and no one investor is smarter than the market.

Solution: Hire a qualified, fee-only investment advisor who can help you invest wisely and avoid costly mistakes.

2 Envy: the grass is always greener in someone else’s portfolio

Many people have stories of a friend-of-a-friend who lucked out by buying and selling an investment at just the right time. So ask that person how he did on his other investments. Ask him, too, if his good fortune was luck, or if his decision was based on some knowledge he had.

Solution: Focus on your portfolio, not your neighbor’s. You have your own goals to accomplish. It is highly unlikely that your friend’s financial goals, risk tolerance and investment time horizons will be the same as yours. Thus, you should align your decisions to meet your long-term financial goals, maintain discipline and stay the course.

3 Lust: making investment decisions based on emotion

People tend to buy investments that have done well recently. Falling blindly in love with a current “hot performer” can be detrimental. Buying based on emotion is one of the worst mistakes investors can make. There are numerous examples of investors buying on emotion, only to end up holding on until the investment has lost most of its value.

Solution: Avoid the daily news (also known as market noise) and ads touting the latest popular investments.

4 Gluttony: investing to excess

Investors often overload on a single investment when it is doing well. This decision can dramatically increase the risk in your portfolio. There are myriad risks in any investment, but overloading your portfolio with a single investment adds a significant amount of risk that you may not be compensated for.

Solution: Diversify your portfolio to reduce risk. You should keep your allocations within your ability, willingness and need to take risk.

5 Sloth: investing without a plan

Having a written plan is an important step that many people ignore. An investment plan should drive all of your investment decisions. Without a sound plan, you may be investing inappropriately by choosing investments that are ill-suited to your goals, time horizons and risk tolerance.

Solution: Develop a written plan that considers your tolerance for risk and volatility. This plan should serve as the roadmap to reaching your financial goals.

6 Greed: chasing returns and ignoring risks

As the saying goes, there is no such thing as a free lunch. There is also no risk-free way to earn a 20 percent annual return. Jumping into an investment as a “sure-thing” in hopes of gaining above average returns is risky, foolish and greedy. In chasing returns, far too many investors have bought high only to sell low when the “hot” investments have cooled off.

Solution: Avoid get-rich-quick promises. Instead, focus on investing for the long-term to achieve your financial goals.

7 Wrath: losing patience while looking for instant results

Wrath is often born out of short-term thinking. Getting frustrated by a lack of positive results and selling quickly is not the way to grow your investments. They take time to mature, and there are no shortcuts. Markets fluctuate, but the long-term trends have always been up.

Solution: Patience pays off. Those who remain steadfast in the bad years typically fare better than those who buy and sell frequently. Investments are like soap — the more you handle it, the less you have.

Resisting temptation

Investment temptations seem endless. Sometimes it’s hard not to get caught up in the market’s highs and lows. Emotions creep in, leading people to make choices that are often misaligned with their overall financial needs and goals.

By recognizing the seven deadly sins of investing, you are better equipped to avoid these mistakes and their negative consequences. You can also improve your ability to achieve your financial goals.