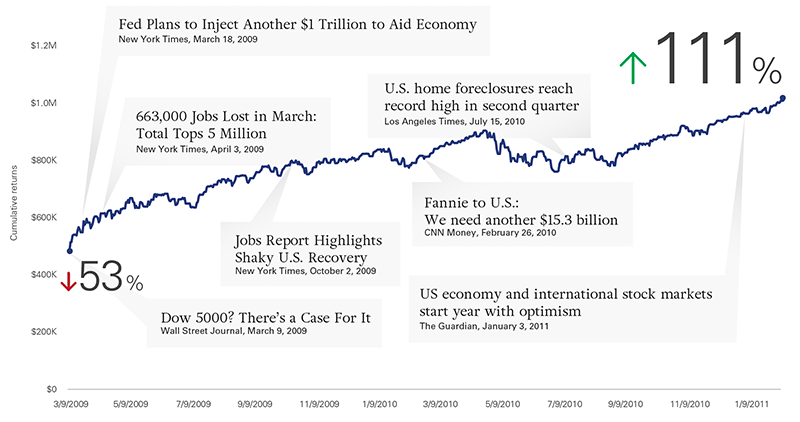

Volatile markets: Don’t rely on headlines for guidance on when to invest

Falling markets and drastic headlines can tempt individuals to abandon their long-term investing plans. Their thinking might go something like, let’s wait until it’s over, hoping to catch the market at its lowest point before buying in. Or in rising markets, maybe they seek to sell most of their holdings near the peak. However, timing the market is essentially an impossible task, as the chart on this page illustrates. It’s good to remember:

Headlines shouldn’t dictate when you invest; they may not reflect what’s actually happening in the market.

A recovery typically involves many episodes of gains and losses that can obscure an overall upward trend.

Just a few trading days can be responsible for the largest gains during a recovery; being out of the market can mean missing out on the most profitable periods.

Don’t rely on headlines for an all clear to invest

Hypothetical $1 million investment in Standard & Poor’s 500 Index at pre-crisis peak, from market bottom in 2009 to breakeven in 2011.

Source: Vanguard.

Note: See the following page for a list of complete citations to the articles cited.

Past performance is no guarantee of future returns. The performance of an index is not an exact representation of any particular investment, as you cannot invest directly in an index.

It’s understandable to have concerns about market volatility and its effect on your portfolio. The situation in the markets is certainly different this time. However, so far, it follows a pattern we’ve seen many times before and have successfully navigated over the years. Bottom line: The “right time” to invest is usually now, whatever the markets’ performance or news headlines might be. By all means, if you have questions or concerns about the plan we created to help you reach your financial goals, please get in touch.

References

Andrews, Edmund L., 2009. Fed Plans to Inject Another $1 Trillion to Aid the Economy. The New York Times (March 18). Accessed March 24, 2020, at https://www.nytimes.com/2009/03/19/business/economy/19fed.html.

Goodman, Peter S., 2009. Jobs Report Highlights Shaky U.S. Recovery. The New York Times (October 2). Accessed March 24, 2020, at https://www.nytimes.com/2009/10/03/business/economy/03jobs.html.

Goodman, Peter S. and Jack Healy, 2009. 663,000 Jobs Lost in March; Total Tops 5 Million. The New York Times (April 3). Accessed March 24, 2020, at https://www.nytimes.com/2009/04/04/business/economy/04jobs.html.

Lazo, Alejandro, 2010. U.S. home foreclosures reach record high in second quarter. Los Angeles Times (July 15). Accessed March 24, 2020, at https://www.latimes.com/archives/la-xpm-2010-jul-15-la-fi-foreclosures-20100715-story.html.

Lobb, Annelena, 2009. Dow 5,000? There’s a Case for It. The Wall Street Journal (March 9). Accessed March 24, 2020, at https://www.wsj.com/articles/SB123654810850564723.

Luhby, Tami, 2010. Fannie to U.S.: We need another $15.3 billion. CNN Money (February 26,). Accessed March 24, 2020, at https://money.cnn.com/2010/02/26/news/companies/Fannie_mae_results.

Milmo, Dan, 2011. US economy and international stock markets start year with optimism. The Guardian (January 3). Accessed March 24, 2020, at https://www.theguardian.com/business/2011/jan/04/us-economy-buoys-international-markets.

Notes:

Please remember that all investments involve some risk. Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Investment Products: Not FDIC Insured • No Bank Guarantee • May Lose Value