Posts by Stephen

Global stocks rebounded in first quarter of 2019

Global stocks rebounded from the late-2018 market correction in the first quarter of 2019. All major stock categories we track posted high single-digit to double-digit returns in the first three months. Bonds also advanced during the quarter as they continued to provide return consistency. While we never know for sure what caused such a swift…

Read More2018 Market Review

After logging strong returns in 2017, 2018 turned out to be one the strangest years we have seen, as global equity markets turned negative despite several highly favorable economic developments.

Read MoreOur perspective on the recent decline of the stock market

The S&P 500 reached a high of more than 2,900 in mid-September but has since declined to about 2,700, representing a high single-digits decline. Despite this drop, the S&P 500 is still close to flat for the year.

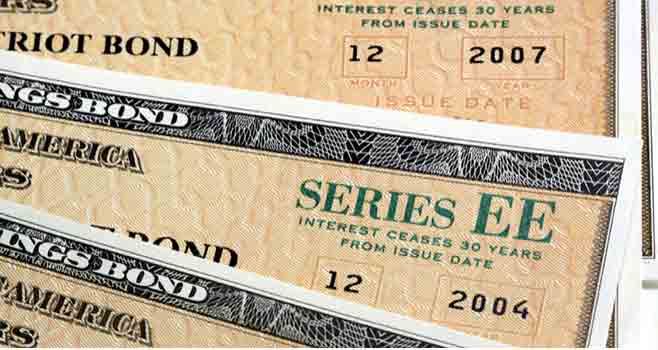

Read MoreHow much do you know about bonds?

It’s important for you, as an investor, to understand your investments. While most investors can easily comprehend stocks, bonds as investments are much more complex. However, there are several potential benefits of investing in them.

Read MoreCorrections are accounted for in the comprehensive planning process

This year kicked off with a strong start for U.S. stocks, but then offered everyone a healthy reality check that markets don’t always go up. A spate of market volatility in February and then again in March tested some investors’ confidence in the equity markets, as well as their ability to stick with their long-term, comprehensive financial plan. It also dominated headlines in the financial media for weeks.

Read MorePerspective on this week’s market events

It looks like the U.S. stock market will finally get something that happens, on average, about once a year: a 10+% percent drop — the definition of a market correction. The last time this happened was a whopper—the Great Recession drop that caused U.S. stocks to drop more than 50% — so most people probably think corrections are catastrophic. They aren’t.

Read MoreEquifax data breach: What you need to know

On Friday, Equifax, one of the major credit reporting bureaus, issued a press release announcing that on July 29, it had discovered “unauthorized access” to data belonging to as many as 143 million U.S. consumers. We have compiled some information that we hope may help you understand what happened and what to do next.

Read MoreDecline in oil prices had the greatest impact on the market last quarter

As we look back at the second quarter, several events — political and otherwise — affected the markets. These events included France’s election of a new president; President Trump’s release of a proposed tax plan; and Britain’s election, in which the prime minister’s party lost seats in Parliament. But arguably, the factor that had the greatest impact on the market, across multiple asset classes, was the sharp decline in oil prices.

Read MoreBoost retirement benefits with a cash balance plan

Business owners may not be able to set aside as much as they would like in tax-advantaged retirement plans. Typically, owners are older and more highly compensated than their employees, but restrictions on contributions to 401(k) and profit-sharing plans can hamper retirement-planning efforts. One solution may be a cash balance plan.

Read MoreDo you have these critical legal documents?

Planning for your death is not the most enjoyable process. Unfortunately, bad things can happen if you don’t. One never knows when tragedy will strike; when it happens, it’s too late to start planning. Getting your affairs in order is advisable for everyone.

Read More